Trump’s much-hyped ‘job boom’ is fake news: 2017 was the worst year for job creation since 2011

Sad!

During his presidential campaign,

Donald Trump promised he’d be the “greatest jobs president God ever created.” And as his administration has become increasingly embroiled in scandal during the first year of his presidency,

Trump has routinely fallen back on bragging about the allegedly unbelievable job creation he’s overseen.

But there’s just one problem — according to the latest jobs data,

2017 saw the most anemic job growth in America since Obama’s first term, when the economy was pulling out of the Great Recession he inherited from George W. Bush.

“U.S. job gains slowed by more than forecast in December, wage growth picked up slightly and the unemployment rate held at the lowest level since 2000, adding to signs of a full-employment economy,” Bloomberg reported. “The job gains, while less than forecast, bring the 2017 total to 2.06 million jobs — below 2016.”

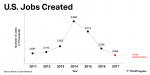

According to data from the Bureau of Labor Statistics,

the 2.06 million jobs created last year were actually the fewest in a year since 2011. Here’s the year-by-year breakdown of jobs added since then.

Even Trump’s favorite TV network — Fox News, which largely covers him uncritically — acknowledges that average monthly job gains during Trump’s first year were the least since 2010.

Fox News Research

@FoxNewsResearch

Average Monthly #Job Gains

-by year

•2017: 171,000

•2016: 187,000

•2015: 226,000

•2014: 250,000

•2013: 192,000

•2012: 179,000

•2011: 174,000

•2010: 88,000

#JobsReport

With an underwhelming job creation record,

Trump’s economic brags of late have mostly been about the stock market.

But the percentage of Americans who own stock is at a historic low — according to research Gallup conducted in 2016, “slightly more than half of Americans (52 percent) say they currently have money in the stock market, matching the lowest ownership rate in Gallup’s 19-year trend.”

In short, stock market gains aren’t necessarily benefiting working-class Americans, and the latest jobs data shows that wages aren’t rising much either. And while Trump is in the habit of touting how the Republican tax cut bill will juice the economy, nonpartisan analyses have concluded that the vast majority of the benefits will accrue to the top one percent.

And as is the case with job creation, Trump’s first-year record with regard to the stock market underperformed Obama’s.

The 2017 jobs numbers also indicate that Trump is misguided in his oft-professed belief that rolling back regulations creates jobs.

During the Obama years, Trump routinely argued that government data showing the job market steadily pulling out of the Great Recession were fake — he called the BLS’ unemployment rate “one of the biggest hoaxes in American modern politics.” But in March, then-Press Secretary Sean Spicer clarified that while the numbers “may have been phony in the past,” they are “very real now.”

In other words, Trump has already foreclosed the possibility of dismissing his unimpressive job creation record as fake news. Sad!